- TAX SOFTWARE FOR MAC 2016 INSTALL

- TAX SOFTWARE FOR MAC 2016 FULL

- TAX SOFTWARE FOR MAC 2016 PASSWORD

- TAX SOFTWARE FOR MAC 2016 DOWNLOAD

On the next screen, choose an appearance for your Office installation, select Continue, and then select the Start Using Word button to open the app and complete the Office 2016 for Mac activation. Select Allow or Always Allow to continue. On the Sign in to Activate Office screen, select Sign In, and then enter your work or school account.Īfter you sign in, you may see an alert asking for permission to access the Microsoft identity stored in your keychain. Review the Word 2016 for Mac What's New screen, and then select Get started.

TAX SOFTWARE FOR MAC 2016 PASSWORD

On the first installation screen, select Continue to begin the installation process.Įnter your Mac login password to complete the installation.Īfter Office 2016 for Mac is installed, Word 2016 for Mac opens so you can activate Office and confirm your subscription.

TAX SOFTWARE FOR MAC 2016 DOWNLOAD

Once the download has completed, open Finder, go to Downloads, and double-click Microsoft_Office_2016_Installer.pkg.

TAX SOFTWARE FOR MAC 2016 INSTALL

On the Software page, under Install Office 2016 for Mac, select Install to begin downloading the installer package. Go to Settings > Office 365 Settings > Software. Download and install Office 2016 for Macįrom your Mac, sign in to Office 365 operated by 21Vianet with your work or school account.

TAX SOFTWARE FOR MAC 2016 FULL

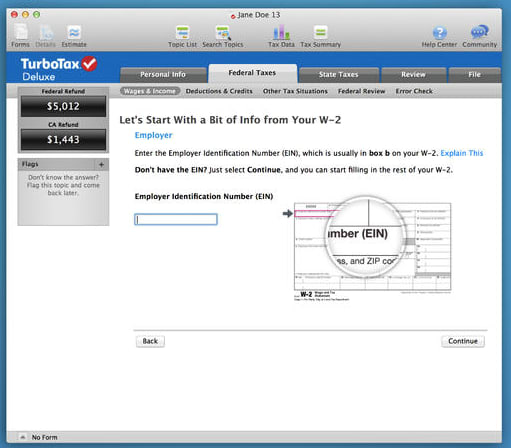

There is now also a TurboTax Live product called Assist & Review that lets you talk to an expert about your taxes and get a final review of your Canadian income tax return before you file for $99.99 per return, and a TurboTax live Full Service product where Intuit's tax experts prepare and file your taxes for you. The online editions do not do incorporate (T2) returns. TurboTax Self-Employed-$59.99 per return.TurboTax Business Incorporated-one corporate T2 return -$249.99.TurboTax 20 Returns-home and business, up to 20 Returns -$139.99.

TurboTax Standard-families, students, and simple small businesses, up to eight returns-$39.99.The EasyStep Interview leads you through the tax preparation process by asking questions in plain English, and tax planning is a snap because of the ability to run multiple tax scenarios, and features such as the capital gains analyzer and incorporation analyzer. TurboTax is a user-friendly Canadian tax software program that lets you prepare your income taxes easily and quickly. There can be quite a difference in price, though, as you'll see in comparing costs of the versions of the software or web app that you would need to use the T1 tax form for a sole proprietorship or partnership. If your business is incorporated, your options are more limited as you need tax software specific to the T2 tax return.Īll these Canadian tax software programs and apps are Canada Revenue Agency approved (and you don't want to use tax software or apps that aren't). If your business is a sole proprietorship or partnership, you'll be able to use any of the Canadian tax software in this article. Most tax software programs include tax planning features so you can analyze different income tax scenarios. Today's tax software and applications do more than just let you calculate your income tax and send in your return. We may receive commissions on purchases made from our chosen links. You can learn more about our independent review process and partners in our advertiser disclosure. Our editors independently research and recommend the best products and services.

0 kommentar(er)

0 kommentar(er)